Trade War Concerns Fuel Volatile Markets

US stocks, commodities and US Dollar witnessed volatile swings this week fueled by trade war concerns after President Trump’s continued rhetoric about potentially adding an additional $100M in Chinese tariffs. This latest round and potential escalation in the back-and-fourth comments between the two nations officials steadied sentiment early in the week, but as the week progressed, markets reacted less and less to walk backs from the President’s advisors.

Friday’s March employment report did little to change the momentum after the payrolls number came in well below expectations, though many analyst cited poor weather largely responsible for the weak employment numbers.

The selling intensified in the afternoon and into Friday’s close after Fed Chairman Powell spoke in Chicago pushing the S&P towards its first weekly close below the 200-day since 2016 before bouncing back into the bell.

Volumes remained relatively muted considering the outsized move by many indices with the buyback quiet period remaining in effect ahead earnings season. Treasuries sold off and the Dollar firmed early on before risk off flows pushed yields lower. For the week the S&P fell 1.4%, the Dow dropped 0.7% and the NASDAQ lost 2%.

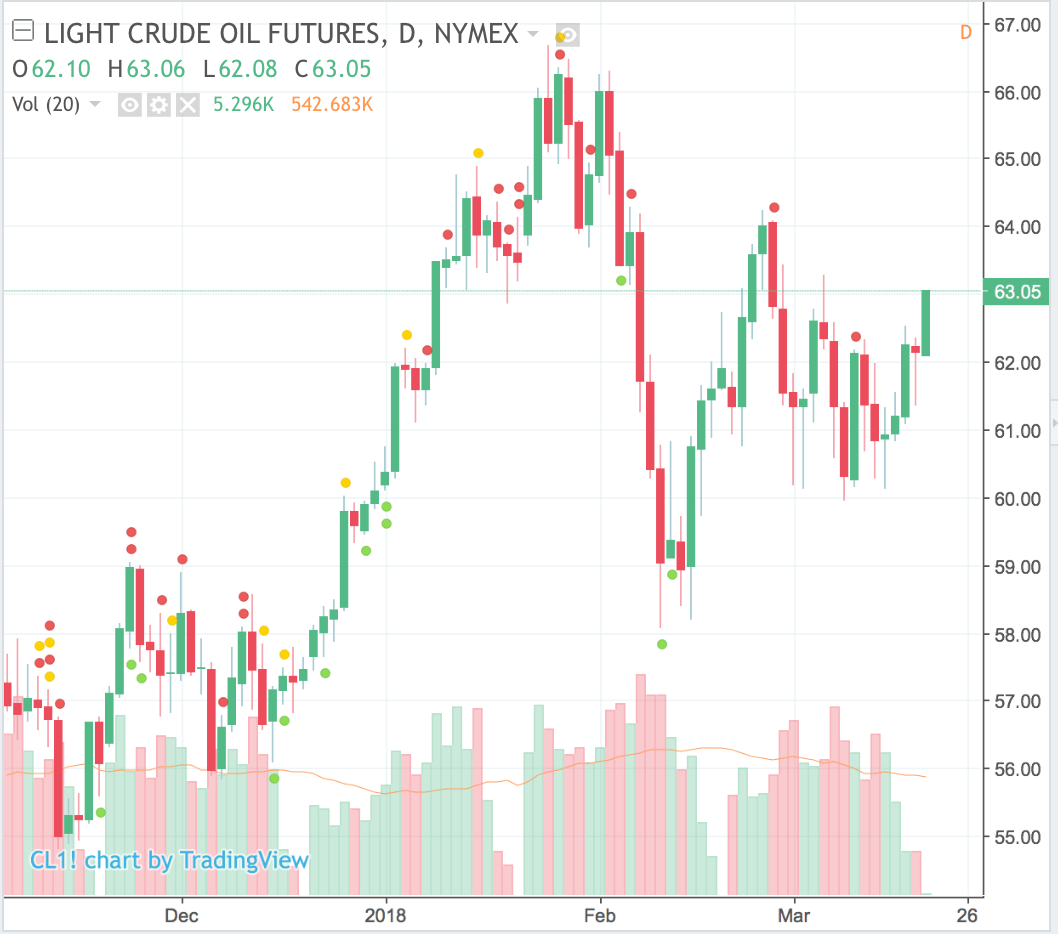

West Texas Intermediate (WTI) also had a volatile week closing lower at 61.90 despite crude oil inventories declining 4.6 million barrels for the week as trade war concerns could possibly threaten the global industrial rebound.

Corporate news was relatively light this week as markets awaited the new earnings season. All eyes were on Amazon as President Trump dispatched a slew of negative tweets and comments about the company and its CEO Bezos, though White House advisers insist no action against Amazon is forthcoming.

News resurfaced that MGM may consider acquiring Wynn if the price were right, as Wynn reels from scandals involving its now-resigned namesake CEO. Humana rose on a report of Walmart’s interest in acquiring the health insurer. The Big Three automakers lifted after posting big beats in their March sales figure.

Tesla deliveries impressed investors despite not hitting Model 3 output expectations yet, though the company continues to expect the rate to increase “rapidly” through Q2. Viacom shares were weighed on by reports that CBS submitted a bid below their current market value.

Next week’s focus will be March US Consumer Price Index (CPI) and Core CPI as any higher than expected number will certainly witness raise concerns that the Federal Reserve will raise rates in 2018 beyond the expected 3 rate hikes.