Investors’ participation in oil and gas partnerships has reached a multi-year high in 2018 primarily due to a sustained rise in prices, but also due to capitalizing on large deductions in the year of the investment. Considered one of the top tax-advantaged investments, oil and gas partnerships not only offer large deductions but also provide the opportunity to receive tax-advantaged investment income.

However, the investment has to be made by December 31st for the investor to receive the tax benefit in the year of investment. The investor should consult their tax advisor to determine their tax liability for the current year and the characterization of the income that caused the liability: passive or non-passive income.

Investors should consider their risk tolerance for such a tax-advantaged and illiquid investments though with deductions up to 100% of their investment, investors can easily offset the risk thru tax savings.

Lawmakers in our effort to achieve energy independence added to the Internal Revenue Code incentives to make drilling for oil and gas a very favorable taxable event with such an investment very tax-favored – intangible drilling costs, a functional allocation exception to the passive loss rules, alternative minimum tax, and the depletion allowance leading the way.

Intangible Drilling Cost

When wells are drilled, the costs associated with the drilling are pided into two types: tangible and intangible. Tangible costs are defined as a salvageable part of the drilling costs and are depreciated over seven years. Intangible costs are the remainder of the costs incurred to drill and complete a well.

Such costs include, but are not limited to: labor, chemicals, grease, fuel, supplies, and other necessary costs for drilling a well and preparing it for production. Based upon the drilling program, the intangible drilling cost may range from 70-85% of the total cost to drill and complete a well.

Functional Allocation

The amount of tangible and intangible drilling costs allocated to investors is based upon each drilling program. In some programs, the investor may receive 100% of the intangible drilling costs and no tangible costs. In other programs, the investor may receive 80-90% of the IDC’s and an allocation of the tangible drilling costs.

The drilling programs do this based upon partnership accounting that allows a disproportionate allocation of revenue and expenses between partners. The Internal Revenue Code requires the allocation to withstand an economic viability test that requires a value to be traded for equal value.

Deductibility of Intangible Drilling Cost

When the investor decides which drilling program to invest in, he receives an allocation of IDC’s – for example 80, 90, or 100%. At this point the investor has options as to when to deduct the IDC’s.

An investor may deduct 100% of the allocated IDC’s in the year of investment.

Or, the investor may choose to amortize the deduction over 60 months, or may elect to deduct part of the IDC’s in the year of investment and capitalize and deduct the remaining IDC’s over a 60 month period. As you can see, there is great flexibility for the investor.

The drilling partner’s obligation is to start, or spud, all the wells within 90 days following the end of the year of investment. This makes the IDC’s deductible in the year of investment. At this stage we have touched on intangible drilling costs, functional allocation, and timing of the deduction.

A quick example may help: cost to drill and complete a well, $1,000,000. Amount of cost that are intangible: 85%. Total intangible drilling cost: $850,000. IDC’s allocated to investors: 100%. Total IDC’s allocated to investors: $850,000.

Exception to Passive Loss Rules

An investment in a drilling partnership would typically be in the form of a limited partnership. This would be considered passive activity in that the investor does not materially participate in the operations in a substantial manner. Accordingly, this investment would only be deductible against passive income.

However, there is a major exception to the passive loss rules. By holding an oil and gas working interest in an entity that does not limit liability (general partner) during the drilling and completion phases, the investor may take the IDC deduction against non-passive income (earned or portfolio income).

This exception to the passive law rules opens up huge opportunities to reduce non-passive taxable income. In most programs investors who elect to be a general partner are converted to a limited partner when all the wells have been completed, as determined by being placed into production. However, if the investor has passive income they can elect limited partner status and receive the benefit of the IDC deduction against their passive income. Hence, you can have your cake and eat it, too!

Alternative Minimum Tax

One of the major questions I receive is how AMT figures into the IDC deduction. By regulation, IDC deductions are not tax-preference items. However, if an investor reduces Alternative Minimum Taxable Income (AMTI) by more than 40%, AMT will be triggered.

If the investor elects to amortize their IDC deduction over 5 years, none of this will be considered excess IDC’s.

When an investment is made in a drilling partnership the investor must monitor his AMTI. The 2018 Tax Cuts and Jobs Act did make some changes with the AMT exemption and threshold amounts.

Depletion Amounts

When the wells the investor owns begin profitably producing, the investor will receive income from the wells. This income will be partially sheltered with a depletion allowance. The current depletion percentage is 15%. Accordingly, for each $1,000 an investor receives, $150 would be tax-free.

Invest in Oil and Gas Partnerships

As you can see, an investment in an oil and gas drilling partnership is a very tax-advantaged investment. Additionally, with global production nearing peak levels while global demand continues to rise, its a mathematical certainty that unless production output dramatically increases, the world will soon witness a global oil shortfall with prices reaching levels not seen since 2008 when oil reached $147 per barrel.

The tax benefits generated by a direct participation in oil and/or natural gas are substantial. The immediate deduction of the intangible drilling costs or IDCs is very significant, and by taking this up front deduction, the risk capital is effectively subsidized by the government by reducing the participant’s federal, and possibly state income tax. Each inpidual participant of course, should consult with their tax advisor.

DISCLAIMER: Viper Capital Partners LLC, is not a Tax Advisor, CPA, or Tax Attorney and is not certified to give any tax advice. The information on this page is for educational purposes only. Inpiduals should consult their own tax professional for advice. Viper Capital Partners LLC offers no professional tax advice.

Contact us for Qualified Investor Application

For further investment information please contact our Investor Relations Department at:

(713) 333-9174

IEA Warns Producers Now Is The Time To Invest

/in Uncategorized /by vipercapitalTuesday, November 13, 2018-The International Energy Agency (IEA) today warned that global oil shortage in the 2020’s decade is a very high probability and now is the time for producers to invest.

IEA stated ” without any future capital investment into existing fields or new fields, current sources of supply (including conventional crude oil, natural gas liquids, tight oil, extra-heavy oil and bitumen, processing gains etc.) would drop by over 45 mb/d over this period.” In other words, existing fields will witness a “natural decline” in supply as this supply decline would create a shortage at current demand levels.

Added to this scenario, the dramatic shift in increasing demand by developing economies,( 80% of the global economies are developing), and the shortfall in supply would be even greater. IEA further states ” doubling of current capital investment in new fields is now required to cure this forecast in global oil shortage.”

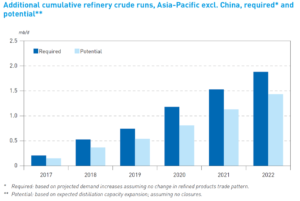

Regions at greatest risk of shortage would be the Asia-Pacific region with supply shortages already beginning to surface. See Chart below.

The United States is the world’s leading oil and natural gas producer followed by Saudi Arabia and Russia. The United Sates has averaged 10.7 million barrels of oil per day in 2018 with peak production at 11.8 mb/d. Failure to meet this global natural decline shortfall would mean that some of the supply-demand “gap” would remain and another source would need to step into the breach.

The most likely candidate to do so would likely be for US operators to increase tight liquids production at a much faster rate than is projected. In this case, US tight liquids production would need to grow by an additional 6 mb/d between now and 2025. Total growth in US tight liquids between 2018 and 2025 would therefore be around 11 mb/d: roughly equivalent to adding another “Russia” to the global oil balance over the next 7 years. Sounds impossible and why IEA is warning producers and their partners that NOW is the time to invest.

Oil Forecast To Remain The Leading Provider of Energy Into 2050

/in Oil Prices, Uncategorized /by vipercapitalWest Texas Intermediate (WTI) reached a multi year high earlier this month at $77.06, not since Oct 2004 has WTI achieved the years high so late in the year. In Oct 2004, WTI was trading at $56.43 and was in the beginning phase of a multi year rise which eventually reached $147 on July 15, 2008.

Similar to 2004, WTI is in a multiyear rise supported by global industrial rebound, however, added to this phase of rising prices is technology driven emerging market growth and demand unlike anything ever witnessed in human history. Economic growth and development outside the United States from emerging and developing economies will pressure oil prices and resources beyond supply capabilities.

Developing economies represent 80% of the world’s population and over the next 25 years these emerging and developing economies will account for 94% of the world’s population growth. Current global population is approximately 7.3 billion with global population forecast to reach 9.2 billion by 2040. Yet, 1.7 billion of that growth will be from developing economies as these economies will demand energy to support their growth and development.

Global GDP currently stands at 87 trillion USD with the United States accounting for 25% or 21 trillion USD. However, China GDP for 2018 is forecast at 14.5 trillion and will grow to 21 trillion by 2023 and forecast to overtake the Untied Sates by 2025.

And what is really scary, its not only China that will lead the way but other economies such as India, Indonesia and surprisingly, Africa.

All these countries will require and demand automobiles and the necessary fuel to run them. Currently the Untied States as 270 million passenger vehicles while China at present has 116 million passenger vehicles. By 2040, the United States is forecast to have 320 million passenger vehicles while China is forecast to have 450 million passenger vehicles. By 2040, the largest sector consuming energy will be the transportation sector.

Furthermore, by 2040, less than 20% of passenger vehicles will be electric vehicles. With global oil demand remaining firm into the decades ahead, oil prices are guaranteed to continue to rise well into the 2050’s. Oil will continue to provide the bulk of the world’s energy needs in 2040 and the United States along with it’s oil producers and partners will lead the way in meeting this demand.

Oil and Gas Considered One of the Best Investments for Yearly Tax Deductions

/in Uncategorized /by vipercapitalInvestors’ participation in oil and gas partnerships has reached a multi-year high in 2018 primarily due to a sustained rise in prices, but also due to capitalizing on large deductions in the year of the investment. Considered one of the top tax-advantaged investments, oil and gas partnerships not only offer large deductions but also provide the opportunity to receive tax-advantaged investment income.

However, the investment has to be made by December 31st for the investor to receive the tax benefit in the year of investment. The investor should consult their tax advisor to determine their tax liability for the current year and the characterization of the income that caused the liability: passive or non-passive income.

Investors should consider their risk tolerance for such a tax-advantaged and illiquid investments though with deductions up to 100% of their investment, investors can easily offset the risk thru tax savings.

Lawmakers in our effort to achieve energy independence added to the Internal Revenue Code incentives to make drilling for oil and gas a very favorable taxable event with such an investment very tax-favored – intangible drilling costs, a functional allocation exception to the passive loss rules, alternative minimum tax, and the depletion allowance leading the way.

Intangible Drilling Cost

When wells are drilled, the costs associated with the drilling are pided into two types: tangible and intangible. Tangible costs are defined as a salvageable part of the drilling costs and are depreciated over seven years. Intangible costs are the remainder of the costs incurred to drill and complete a well.

Such costs include, but are not limited to: labor, chemicals, grease, fuel, supplies, and other necessary costs for drilling a well and preparing it for production. Based upon the drilling program, the intangible drilling cost may range from 70-85% of the total cost to drill and complete a well.

Functional Allocation

The amount of tangible and intangible drilling costs allocated to investors is based upon each drilling program. In some programs, the investor may receive 100% of the intangible drilling costs and no tangible costs. In other programs, the investor may receive 80-90% of the IDC’s and an allocation of the tangible drilling costs.

The drilling programs do this based upon partnership accounting that allows a disproportionate allocation of revenue and expenses between partners. The Internal Revenue Code requires the allocation to withstand an economic viability test that requires a value to be traded for equal value.

Deductibility of Intangible Drilling Cost

When the investor decides which drilling program to invest in, he receives an allocation of IDC’s – for example 80, 90, or 100%. At this point the investor has options as to when to deduct the IDC’s.

Or, the investor may choose to amortize the deduction over 60 months, or may elect to deduct part of the IDC’s in the year of investment and capitalize and deduct the remaining IDC’s over a 60 month period. As you can see, there is great flexibility for the investor.

The drilling partner’s obligation is to start, or spud, all the wells within 90 days following the end of the year of investment. This makes the IDC’s deductible in the year of investment. At this stage we have touched on intangible drilling costs, functional allocation, and timing of the deduction.

A quick example may help: cost to drill and complete a well, $1,000,000. Amount of cost that are intangible: 85%. Total intangible drilling cost: $850,000. IDC’s allocated to investors: 100%. Total IDC’s allocated to investors: $850,000.

Exception to Passive Loss Rules

An investment in a drilling partnership would typically be in the form of a limited partnership. This would be considered passive activity in that the investor does not materially participate in the operations in a substantial manner. Accordingly, this investment would only be deductible against passive income.

However, there is a major exception to the passive loss rules. By holding an oil and gas working interest in an entity that does not limit liability (general partner) during the drilling and completion phases, the investor may take the IDC deduction against non-passive income (earned or portfolio income).

This exception to the passive law rules opens up huge opportunities to reduce non-passive taxable income. In most programs investors who elect to be a general partner are converted to a limited partner when all the wells have been completed, as determined by being placed into production. However, if the investor has passive income they can elect limited partner status and receive the benefit of the IDC deduction against their passive income. Hence, you can have your cake and eat it, too!

Alternative Minimum Tax

One of the major questions I receive is how AMT figures into the IDC deduction. By regulation, IDC deductions are not tax-preference items. However, if an investor reduces Alternative Minimum Taxable Income (AMTI) by more than 40%, AMT will be triggered.

When an investment is made in a drilling partnership the investor must monitor his AMTI. The 2018 Tax Cuts and Jobs Act did make some changes with the AMT exemption and threshold amounts.

Depletion Amounts

When the wells the investor owns begin profitably producing, the investor will receive income from the wells. This income will be partially sheltered with a depletion allowance. The current depletion percentage is 15%. Accordingly, for each $1,000 an investor receives, $150 would be tax-free.

Invest in Oil and Gas Partnerships

As you can see, an investment in an oil and gas drilling partnership is a very tax-advantaged investment. Additionally, with global production nearing peak levels while global demand continues to rise, its a mathematical certainty that unless production output dramatically increases, the world will soon witness a global oil shortfall with prices reaching levels not seen since 2008 when oil reached $147 per barrel.

The tax benefits generated by a direct participation in oil and/or natural gas are substantial. The immediate deduction of the intangible drilling costs or IDCs is very significant, and by taking this up front deduction, the risk capital is effectively subsidized by the government by reducing the participant’s federal, and possibly state income tax. Each inpidual participant of course, should consult with their tax advisor.

DISCLAIMER: Viper Capital Partners LLC, is not a Tax Advisor, CPA, or Tax Attorney and is not certified to give any tax advice. The information on this page is for educational purposes only. Inpiduals should consult their own tax professional for advice. Viper Capital Partners LLC offers no professional tax advice.

Contact us for Qualified Investor Application

For further investment information please contact our Investor Relations Department at:

(713) 333-9174

Recent News | WTI Hits Our Forecast Target $76.47, Where to Next?

/in Uncategorized /by vipercapitalWest Texas Intermediate (WTI) ($76.37)

Technical Outlook

West Texas Intermediate reached the $76.47 target cited in our January 2018 and March 3, 2018 forecast today with an intraday high of $77.06 and closed today at $76.37. This level found bids in 2011-2012 when prices ranged $74.95-112.56 for several months before a downside break of this $75 level in Nov 2014.

However, after testing offers at $75 last July, prices eventually moved lower to challenge bids at $64.58 which is just a few cents above the 200-month simple moving average. As to the upside, look for daily prices to open above $77.06 and close higher followed by a weekly open and higher close above $77.06 to confirm further price rise is once again under with $88.67 as the next upside target. As to the downside, $57.46 remains as key mathematical support while the recent $77.06 limits the upside.

A daily open and lower close below $57.46 followed by a weekly open and lower close will complete the rise from the Feb 2016 low of $25.75 at $77.06 with further price decline to test bids at $51.41. The more probable outlook with a 77% probability will be 51.41 bids will eventually witness a sustained break of $77.06 for $88.67 target. Above this 88.67 level will witness a 93% probability of prices continuing higher to $105-108 in the months ahead. More on that outlook later as this scenario unfolds.

Fundamental Outlook

Global demand by rapidly developing and technology-driven expanding emerging economies is the primary reason for sustained oil prices as this coupled with global production currently at 92% of capacity will continue to witness rising prices into the months ahead.

These emerging economies have average growth in Gross Domestic Product (GDP) of 6% per year for the last five years with the top emerging economies averaging over 10-15% per year since 2013. (GDP is the total goods and services produced by an economy in a monetary measure.) And all these economies need oil and the three largest producers of oil in the world are the United States, Saudi Arabia, and Russia.

Consumption Forecast for 2019 is 104 million barrels per day and the current maximum capable production of oil in the world from all sources at 100% utilization is approximately 107 million barrels a day. Do the math, the world is nearing a global energy shortage. Oil is used to run the power plants which produce most of the world’s electricity. The world is on a razor-thin margin between surplus and deficit.

Unlike the great wealth transfers from the oil booms of the 1970’s. 1980’s and 1990’s where the middle east was the beneficiary, this time it will be the United States and it’s oil producers and partners.

Recent News | West Texas Intermediate (WTI) Technical Outlook

/in Uncategorized /by vipercapitalWest Texas Intermediate (WTI) (69.01)

Short-Term Outlook

WTI achieved $75.38 last month, just about a buck shy of the $76.47 target from our January 2018 forecast and restated in our Mar 3, 2018 forecast. Short term prices at this writing showing evidence to move lower as daily prices have opened and closed below the 20-day moving average (69.65) though remaining above the 200-day moving average since Sept 2017.

Key mathematical support comes in at 63.95 and the 200-day moving average at 64.16, as these levels found bids in June with institutional buying and futures traders bids moving prices to the 2018 high of 75.38 in July.

To the downside, look for daily prices to open and close below 63.95 to support further price decline to 60.42 as a daily open and lower below 63.95 followed by a weekly open and lower close will complete the rise from the September 2017 low of 45.48 at the 2018 high 75.38 and risk further price decline to 56.90 with the probability of price consolidation within a 56.90-63.95 zone.

As to the upside, only a daily open and higher close above 75.38 will support a further rise to our 2018 target of $76.47 and higher. More on this outlook as it unfolds..

Medium-Term and Long-Term Outlook

Both the medium term and long-term models support continued prices rise in WTI into the months and years ahead as both models confirming 77% probability that prices will witness 108.11 (2014 high) before 25.75 (2016 low), though this % probability will dramatically improve as weekly and monthly prices open and close above the following mathematical levels resulting in the subsequent probability % outcome, 76.47 (83%), 88.32 (93%).

In other words, weekly prices and monthly prices opening and closing higher above 88.32 will result in a 93% probability that prices will move to 108.11.

However, until such a break occurs, both the medium term and long-term models support a broad range of 45.08-88.32 into the months ahead and a short-term range of 51.41-75.38. ONLY a sustained move outside either range will witness continued price move in the direction of the range break. More details on this scenario once the breakout occurs.

The vast majority of the world economies are emerging as opposed to the advanced economies such as USA, Canada, Japan, France, UK, Germany, Italy, These emerging economies have average growth in Gross Domestic Product (GDP) of 6% per year for the last five years with the top emerging economies averaging over 10% per year since 2013. (GDP is the total goods and services produced by an economy in a monetary measure.)

And all these economies need oil and the three largest producers of oil in the world are the United States, Saudi Arabia, and Russia. Current global consumption is approximately 100 million barrels per day with current global output essentially the same. Consumption Forecast for 2019 are 104 million barrels per day and the current maximum capable production of oil in the world from all sources at 100% utilization is approximately 107 million barrels a day.

Oil is used to run the power plants which produce 80% of the world’s electricity. The world is on a razor-thin margin between surplus and deficit.

Unlike the great wealth transfers from the oil booms of the 1970’s. 1980’s and 1990’s where the middle east was the beneficiary, this time it will be the United States and it’s oil producers and partners. Oil prices are going higher and it will dramatically change our way of life in the future.